On October 27th, 2016 we hosted our annual seminar at Orchard Lake Country Club. We were very excited to present our first guest speaker, attorney Michael A. Alaimo from Miller Canfield. Alaimo spoke for the first half of our seminar on the much talked about U.S. D.O.L. Ruling on Overtime that goes into effect on December 1. Alaimo, who previously worked for the D.O.L., was able to provide insight from both the D.O.L. side and the employer side to give attendees a full view of the issues at stake. Download a copy of the FLSA Overtime Risk Scorecard attendees received at the bottom of this post!

The basic rule for paying overtime is that all “non-exempt” employees must be paid 1.5 times their regular hourly rate of pay for any hours worked over 40 in a work week. Exempt employees are paid on a salary basis and are paid their full amount in any week work is performed. No deductions are made to exempt employees pay as a general rule though there are a few exceptions.

An employee becomes “exempt” from overtime pay when they meet one of these primary exemptions: Administrative, Professional, Executive, Computer Related Occupation, Outside Sales. Alaimo reminded us to consider the possibility that some positions may be open to interpretation in litigation. For example, he listed a previous case where it was argued that a plant supervisor met the Executive Exemption due to his managerial duties on a day-to-day basis. For more information on the “white collar” exemptions check out this small business compliance guide directly from the D.O.L.

The new overtime rule has increased the minimum salary levels of most exemptions from $455 per week (#23,660 per year) to $913 per week ($47,476 per year). This new level equals the 40th percentile of weekly earnings for full-time salaried employees in the lowest wage U.S. Census region (currently the south).

The rule also includes a provision that states the minimum salary level will be increased every three years, which was not in place previously. The standard threshold will be increased based on the 40th percentile of full-time salaried worked in the lowest wage U.S. Census region. It is estimated to reach $51,168 in 2020. The highly compensated employee threshold will be increased based on the 90th percentile of all full-time salaried workers nationally. This is estimated to reach $147,524 in 2020. The new salary levels will be posted by the U.S. D.O.L. 150 days in advance of the effective date starting August 1, 2019.

If you have exempt employees who also receive non-discretionary bonuses, incentive pay, or commissions this pay can count for up to 10% of the base salary requirement for non-HCE employees. However, these payments must be made at least quarterly. An employer must be paying at least 90% of the minimum salary weekly ($821.70) and by the end of each quarter must ensure that all payments equal $11,869 (1/4 of $47,467).

There have been no changes to the duties test under the D.O.L.’s assumption that the increased minimum salary will relieve employers from applying the duties test. There are also no impact or changes on exemptions that do not require payment on a salary basis (e.g., doctors, lawyers, teachers).

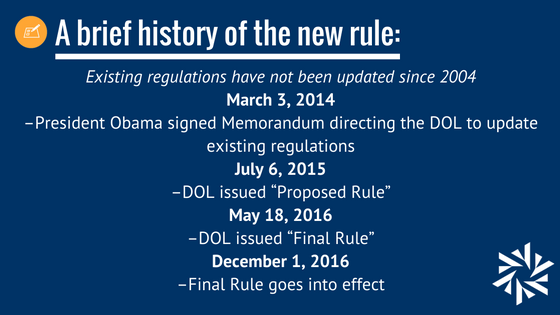

The U.S. D.O.L. made their ruling for a few reasons, and we should keep in mind that existing regulations have not been updated since 2004. The exemptions are premised on the fact that workers earned salaries well above minimum wage and also enjoyed other privileges, benefits, and opportunities for development. However, the current salary level threshold ($455 per week) is below the poverty level for a family of four and is only 1.6 times the federal minimum wage. The new salary level is twice the poverty level for a family of four and is 3.1 times the federal minimum wage.

Their intent is to put more money into the pockets of middle-class workers and give them more free time. By implementing the three-year reviews they want to prevent future erosion of overtime protections and ensure greater predictability. They also want to strengthen overtime protections for salaried workers already entitled to overtime and provide greater clarity for workers and employers.

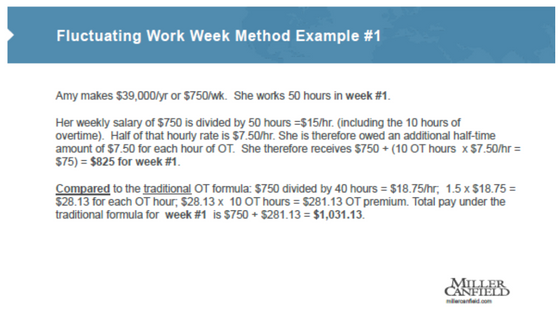

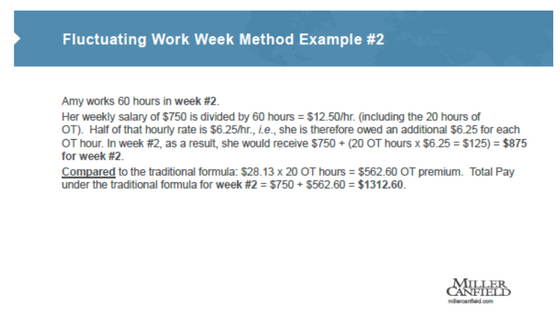

There are several options for employers to maintain compliance with the new ruling. Salaries may be raised to meet the threshold, keep salaries the same and pay overtime at 1.5 times their rate after 40 hours, reorganize workloads to spread hours among employees, maintain current salary but factor in a separate rate for overtime, or utilize the fluctuating work week method.

The new rule is sure to have many impacts, though some employer responses could include the following: cut in hours to avoid overtime, lower base rates to absorb cost of overtime, less flexibility due to time tracking, increased administrative costs, decrease in morale for employees who like to be salaried, increase in unemployment.

The new rule is sure to have many impacts, though some employer responses could include the following: cut in hours to avoid overtime, lower base rates to absorb cost of overtime, less flexibility due to time tracking, increased administrative costs, decrease in morale for employees who like to be salaried, increase in unemployment.

Other concerns may include the concept of joint employment which may affect businesses utilizing staffing agencies, contract workers, or cases where a worker has employment relationships with two or more employers. Consequences for cases of “joint employers” may include: aggregation of hours worked, joint/several liability, and/or liability for FLSA violations committed by another employer.

We are very grateful to Michael A. Alaimo coming to give his expertise at our seminar regarding this ruling that is sure to affect many employers. For any Austin clients that are interested in receiving the full presentation materials, please contact ericak@austinbenefits.com. Be sure to watch out for our next Austin Seminar in 2017!

Special Note: The new rule will not impact a state or local government’s ability to obtain an agreement with employees to provide comp time in lieu of payment of overtime up to the maximum of 480 hours for emergency response personnel.