How to Easily Answer These Most-Asked Open Enrollment Questions

Is my current doctor in-network? If not, how much more expensive is it to continue seeing them?

Bookmark our Provider Directory of Southeastern Michigan’s top carriers to easily do a provider search for your employees. Make sure your materials show both in and out of network costs and consider an example showing the real-life cost savings of using an in-network doctor.

Are my medications covered? How can I spend less on prescriptions?

Check if a prescription is covered from the carrier or their Pharmacy Benefits Management company. For example, the Blues plans, use Express Scripts. Some PBMs, like Express Scripts, also have handy apps to check on medications, sign up for home delivery, etc.

If your employees are worried about the costs of brand name or higher tier medications, you can advise employees to check with their doctor or pharmacist if a generic drug is available. Some pharmaceutical companies may offer special discounts on their brand name drugs.

Just as your group health plan covers specific medications, your health plan also allows specific pharmacies, referred to as “in-network”, for filling prescriptions. You and your employees can check with your insurance provider or contact Austin Benefits Group for help finding in-network pharmacies.

Your employees may be able to save even more by using an approved mail-order program for their prescriptions.

What’s a deductible, coinsurance, and out-of-pocket maximum?

Having a detailed glossary of healthcare terms is helpful for employees, but you can take the next step by showing how these pieces of a health plan work together (and differently by plan type).

Austin Benefits Group illustrates these important amounts side-by-side for all your plans, so eligible employees get a clear at-a-glance comparison. You can utilize video to help your employees get an easier to understand look at these confusing terms.

Read More: How to Improve Health Care Understanding at Open Enrollment + FREE Glossary

Why would I want a high-deductible plan? Aren’t I paying less with an HMO or PPO?

Since its emergence on the health market, the high-deductible health plan has gotten a bad reputation. On paper, employees may have a hard time seeing the benefits of this plan type, especially when they already feel more comfortable with PPO and HMO plans.

Try using a simple explainer video or a visual representation of how an HDHP works in comparison to other plans. It’s important to illustrate how the plan can work differently for single employees or families.

Does my health insurance cover chiropractic care? Mental health? Physical therapy? Acupuncture?

If your plan covers any of these desirable services, make sure to show it off! Send pre-open enrollment emails or text messages about special services covered by your medical plans.

At Open Enrollment, include these services in your presentation, webinar, printed materials, or videos that you use to educate employees on your benefits. Often, these types of services are covered only for a certain number of visits, so be sure that employees know how much they pay for covered and not-covered visits.

In addition to desirable special services, feature special discounts and programs offered by your health care or other carriers. For example, Blues members are eligible for the Blue 365 program which offers rotating benefits in health, fitness, and wellness. Guardian members may be eligible for a College Tuition Savings program on select dental plans.

Is it worth it get dental and/or vision insurance? I’m already spending a lot on health insurance.

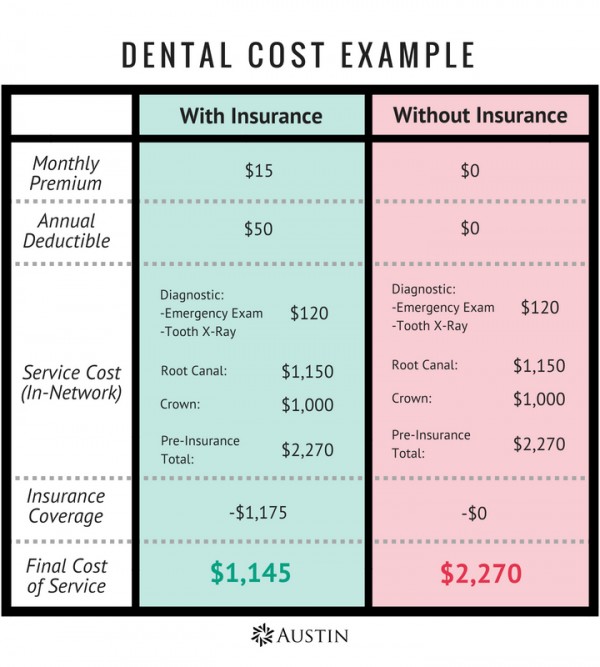

Remind employees that medical insurance will not cover basic dental and vision care such as cleanings or eye exams.

Regular dental and vision exams can treat problems and identify other serious health concerns, including some types of cancer. Dental and/or vision coverage will allow you to inexpensively receive both preventive and diagnostic care.

In many cases, if employees need more services than just an exam, the cost of the insurance premium and copays will be savings versus paying completely out of pocket.

Read More: The Beginner’s Guide to Dental Insurance & Savings

I already signed up for benefits when you hired me. Do I really need to do this all over again?

New Hire enrollment is to get benefits during the current plan year, while Open Enrollment is to make elections for the upcoming plan year. Make sure to advise employees that this is their only chance to make changes unless they experience a Life Event.

Read More: Qualifying Life Events

If you offer passive enrollment (employees keep plans from the previous year if they don’t make changes) make sure to communicate this in advance. Employees may assume they will automatically be waived or enrolled in newly offered plans.

How do I know how much money to put in my FSA/HSA when I don’t know what I’ll spend next year?

The best way to help employees figure out what they may want to contribute to their tax-benefited accounts is to look at their previous year’s spending and plan based on the account type.

Flexible Spending Accounts may have a $500 rollover feature, but in general, the funds are “use-it-or-lose” each year. Health Savings Accounts funds do not expire. Employees may want to max out their HSA accounts in preparation for retirement. Employees with an FSA may only want to elect enough to cover their known medical expenses up to the rollover amount. Don’t forget to mention your Dependent Care Account (and how to use it), as this can be a great money-saver for families.

Considering your employees’ different goals and concerns is an effective way to help start them on the right path with tax-benefited accounts.

Read More: 2018 FSA Limits Increase & How to Spend Your FSA | Are HDHPs & HSAs Giving You a Fright? FREE HSA Scenario Guide

How can I make sure I’m saving enough in my 401(k) and preparing for retirement?

Be careful when talking finances with your employees, financial advisors need specific licensing in the U.S. If you offer a 401(k) or other retirement savings plans, let your administrator take the lead on advising. We recommend holding a 401(k) meeting at the same time as Open Enrollment since this is often when employees will ask questions about your offerings.

Remember, if you’re an Austin Benefits client, your dedicated Account Manager and Enrollment Specialist as available to directly handle your employees’ Open Enrollment and benefits questions. Your Austin team includes a communications specialist who can create custom marketing materials to help your employees better understand your benefits package and learn more about how to get the best value from their benefit selections.

Like these ideas? Share this with your internet friends and follow us using the links below! We appreciate you spreading the benefits love.