A Health Savings Account (HSA) is a tax-advantaged1 medical savings account that helps participants save money to use towards paying for their medical expenses. To be eligible to participant in an HSA, you must be enrolled in a HSA-qualified high deductible health plan (HDHP)2. HDHPs and HSAs have been on the rise in recent years as the cost of health care continues to rise.

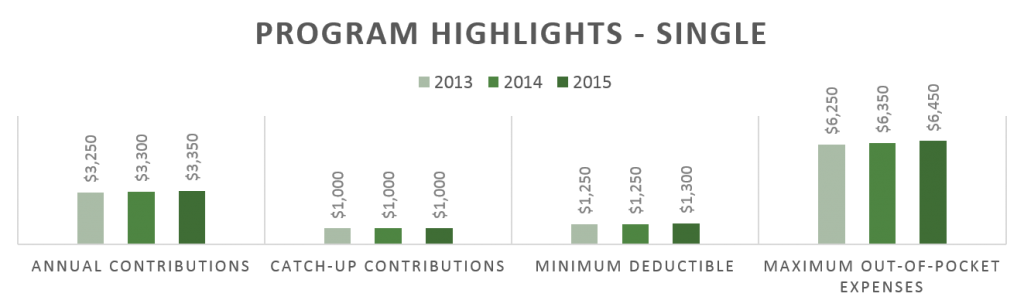

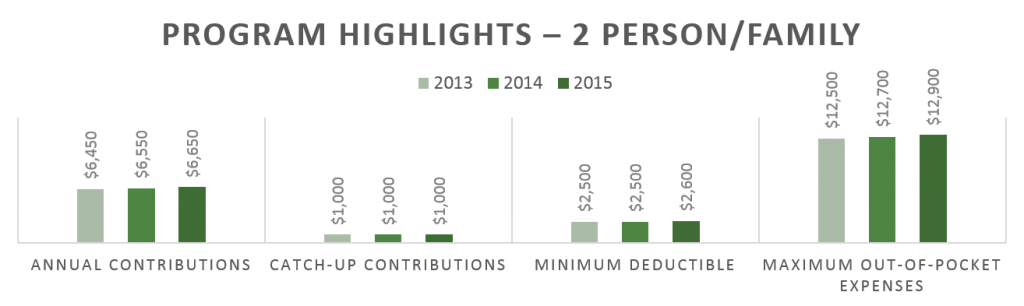

Take a look at the following graphs to see a comparison of changes since 2013:

- Annual Contributions: The most money you can contribute to an HSA account

- Catch-Up Contributions: Available to HSA participants age 55 or older who are not enrolled in Medicare

- Deductible: The cost you must pay before a plan begins to pay for covered services you use

- Out-of-Pocket Expenses: The most you could pay for services and copays during a coverage period

Source: http://www.benefitspro.com/2014/04/23/irs-announces-2015-hsa-limits#.U1lXe0Z4cYY.facebook

1 All tax references are at the federal level. State taxes may vary.

2 Contact your insurance provider if you have questions on whether your health coverage is a qualified HDHP.