If your employer offers a qualified high-deductible health plan (HDHP) as part of your benefits package, you are eligible to set up a health savings account (HSA). While a higher deductible can cause sticker shock compared to traditional plans, HDHPs typically offer premium savings. A health savings account is the funding tool designed to help you put pre-tax dollars aside for qualified expenses including your deductible.

How to Enroll:

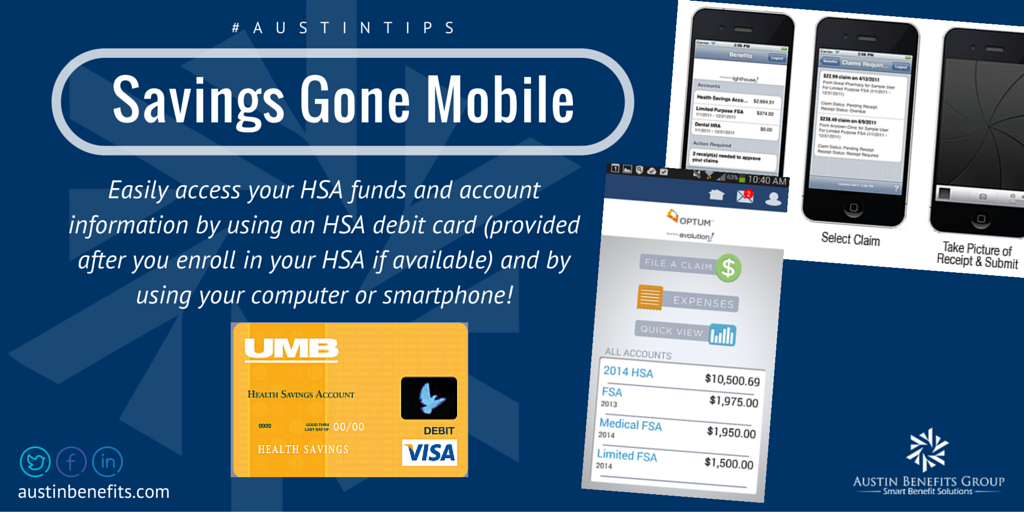

Your health savings account may be administered through a bank your employer has made an agreement with, like UMB, Basic or Optum Bank. You would be able to find this information on your enrollment form(s) or in other benefits communication materials. If your employer has not set up group administration of your HSA, you can enroll directly through your preferred banking institution.

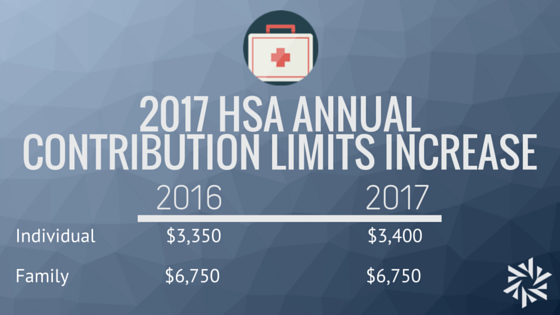

You can elect how much you want to contribute to your HSA at open enrollment. Limits for HSAs are announced by the IRS each year, based on the federal cost of living adjustments. The limits for 2017 are $3,400 for individual coverage and $6,750 for family coverage.

If you set up your HSA with your employer’s administrator, your election amount is deducted over the course of the year from your paycheck. Your HSA balance will build over time.

Using Your HSA:

Once you have elected and set up your health savings account, and balance has accrued from your pre-tax paycheck deductions, you can start using the funds to pay for qualified expenses. You can use your HSA funds to pay for out-of-pocket costs including copays or coinsurance.

Many HSA administrators provide debit cards so you can spend your HSA dollars like other forms of payment. You may need to provide receipts to confirm that the purchases are qualified, so make sure to keep a good record of your purchases. There may be websites or mobile apps available for you to easily manage your HSA account balance and check your history. Keeping on top of how much funds you use from your HSA can help you determine changes you may want to make to your contributions at your next annual enrollment.

Important Notes:

If you are a dependent on someone else’s income tax return, you will not be eligible for an HSA.

Although you will lose eligibility for an HSA at age 65 (Medicare eligibility) you can still use your balance tax-free for medical expenses, including reimbursing yourself for Medicare premiums.

It’s important to present your medical card for services and products so that your insurance carrier can track eligible expenses against your deductible. Your insurance carrier may also have negotiated discounts with certain providers, like the Blue 365 program from Blue Cross Blue Shield of Michigan and Blue Care Network.

Contact Austin Benefits Group for a personal consultation on high-deductible health plans and health savings accounts. We’re here to help you make the most out of your investment in your health!

For more information on Health Savings Accounts, check out our free EBOOK!