Why You Need to Offer Multiple Health Plans

Offering your employees choice in benefits gives them the ability to select the plans that are best for their particular needs. If you only have one health plan, your employees don’t have much choice in healthcare – the most desirable benefit after monetary compensation.

In the 2017 Employee Health Benefits Annual Survey, 58% of covered employees only have one type of health plan offered by their employer. Since health care is so important to your employees, offering them more choice in plans can have a significant effect on attitude towards your overall benefits package.

Offering Multiple Health Plans Empowers Employees & Increases Retention

When employees feel they have more choices (and choices that are applicable to them) they feel understood and cared for by their employers. They don’t feel forced into a one-size-fits-all choice, especially since health care is such an important part of their lives.

Employees may also feel more engaged in their overall healthcare by wanting to take advantage of their plan choice. When employers offer more health care choices as well as great benefits communication and education, employees can feel truly confident in their benefits.

Read More: How to Become a Better Health Care Consumer | How to Increase Health Care Understanding at Open Enrollment

Having multiple health plans can also appeal to your future employees, by standing out from other employers in your industry and local area. Make sure to share that your company offers a wide range of benefits (you don’t have to be specific). Good places to share general tidbits about your benefits package are your careers page, Glassdoor, job fairs, etc.

How You Can Customize Your Health Plan Choices

Plan Types

HMO – Offering an HMO plan may seem like less choice, because employees have to stay in-network to save the most money. However, contemporary HMO networks are much larger than when this plan type first came about. HMOs offer both singles and families great savings when they don’t need a wide range of specific doctors and they can wait for referrals.

PPO – A PPO is a plan most employees are familiar with and may feel more comfortable having a lot of choices in doctors, hospitals, and other providers. This is still a great option for your employees who do need a range, whether for themselves or family members. PPOs may seem like a big expense for companies, but you can check different coverage levels (metal tiers) to keep your PPO affordable for you and your employees.

HDHP/CDHP – High deductible plans can be advantageous for employers and employees because they tend to have low premium costs like some HMOs, but the choice level of a PPO. The problem is that many employers focus on premium savings, and not how an employee can best use HDHPs since there are different rules than with a PPO. Offering an HDHP can be a good addition to either your existing HMO or PPO for employees who are interested in premium savings, provider choice, and retirement savings.

Coverage Levels

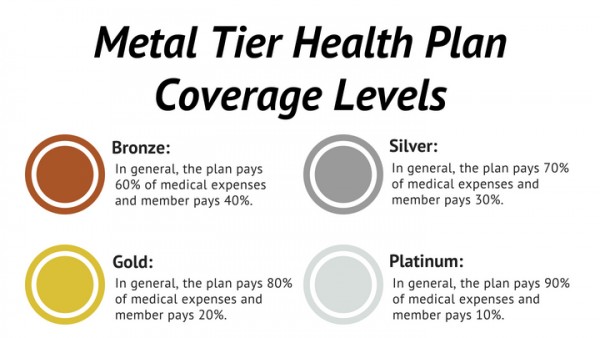

Offering a range of coverage levels within the same Plan Type can still offer your employees choice. They can essentially choose if they want to pay more upfront (for premiums) or pay more at the point of service (coinsurance, copay, deductible). A broker like Austin Benefits Group can help you balance premium cost and coverage level, ask about our renewal marketing process.

Deductibles

You can also look at offering plans with different deductibles, similar to changing coverage levels. Offering an HMO with a low deductible and a PPO with a higher deductible can help balance costs between plans for employers, and give two great choices for employees.

Offering a very low deductible is a high-value benefit within your healthcare offerings. Consider offering at least one low-deductible option to stand out from other employers. You can adopt different contribution strategies between plans to control your costs.

If you have mostly high-earners in a specialty industry, higher medical costs may be a lower priority – so check in with your employees and review industry trends.

Carriers

Having plans from different carriers may not be your first thought when it comes to different health plan options. If you have employees in different parts of your state, or even different states altogether, offering different carrier options can give peace of mind to your employees.

Often, a few or only one carrier dominate the market in certain areas, which means that a less common carrier may not have a lot of in-network provider options for certain employees. Checking on which carriers can give the best networks to as many of employees as possible can be one more way to give choices to your employees.

All these multiple health plan options got your head spinning? Make sure you have a trustworthy benefits partner on your side. You can contact Austin Benefits Group to talk benefits, healthcare, technology and human resources!