Disability insurance may be among the most overlooked in the benefits industry. People often mistakenly think they are already covered, can easily get government coverage, or that it’s not relevant to them. At least 1 in 4 of today’s 20 year-olds will become disabled before they retire.1 Can you live without your paycheck for a few weeks, a few months, or a few years?

Disability insurance is needed most often in cases of illnesses like cancer, heart attack or diabetes – not accidents or work-related injuries.2 If your injury or illness is not work-related, it will not be covered by worker’s compensation, so you need to have an alternative form of coverage.

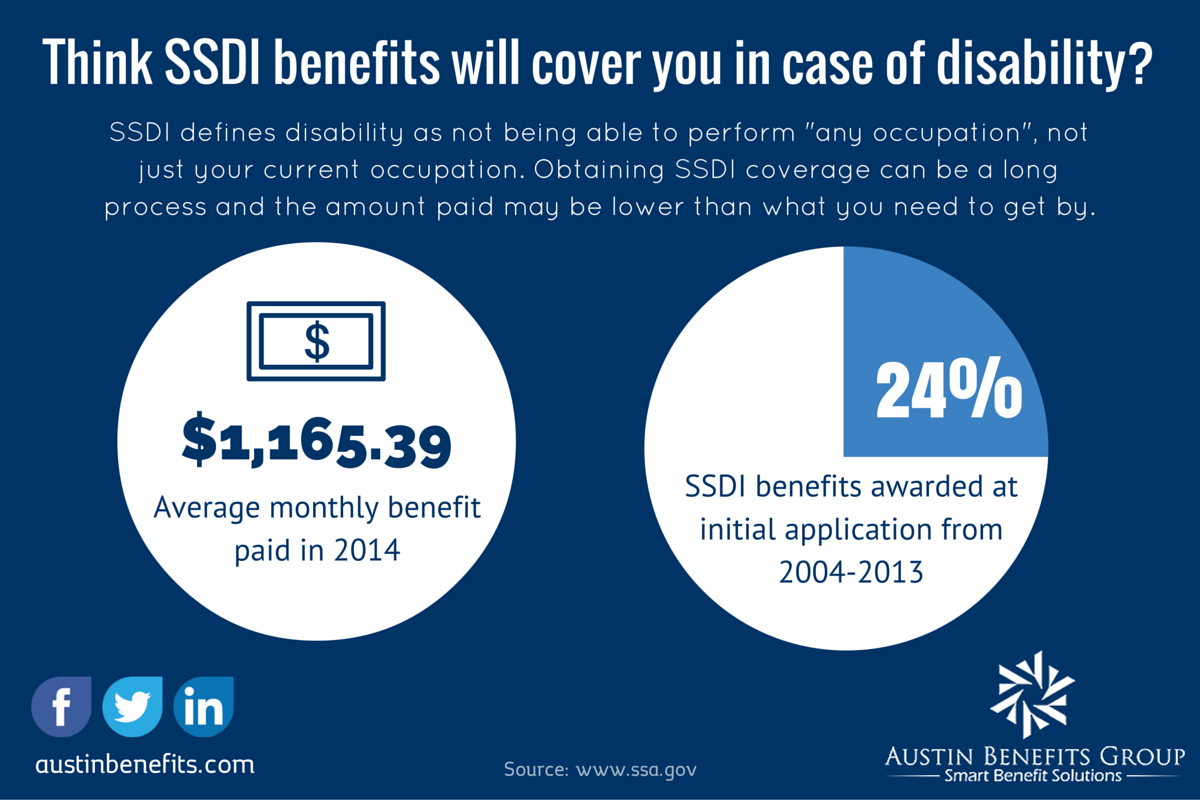

Think you’ll just file for Social Security disability insurance (SSDI)? You may want to think twice, the percent of SSDI benefits awarded at initial application averaged only 24 percent from 2004-2013.3 Why so low? SSA strictly defines disability as not being about to perform “any occupation”, not just your current occupation. The average compensation through SSDI is also likely less than coverage you can obtain through your employer or privately. The average monthly benefit paid in 2014 was only $1,165.39.4

Your employer only offers voluntary disability benefits? Don’t just shrug off this opportunity as a drain on your paycheck. The small cost of these voluntary benefits can prevent your savings being drained by unforeseen circumstances. Enrolling in your company’s group voluntary disability coverage will most likely offer you savings over enrolling individually.

So, what should you be reviewing in your employer’s disability insurance or when purchasing your own policy? You want to be sure you have enough funds provided through the coverage, most employer-provided policies will cover about 60% of your paycheck in either short-term or long-term disability insurance. Will that be enough for your expenses, or should you consider supplemental coverage? Also, consider if the policy defines disability as the inability to perform “own occupation”, your current job function, or as “any occupation”, or the ability to do functions for any type of job.

When enrolling in disability insurance, you’ll also have the option to select short-term and/or long-term options. Short-term disability benefits will cover you for a set period, usually well under one year. Long-term disability offers coverage for periods that can extend up until age 65 or lifetime in some cases, most plans are designed to go into effect after the short-term policy would end. Keep in mind that there are usually waiting periods from the time of accident or illness for short-term and long-term benefits to begin paying out.

Ready to secure protection for your paycheck? Talk to your HR representative today to find out if your employer offers disability insurance options.

Looking to implement new short-term or long-term disability insurance benefits for your company? Contact your dedicated Account Manager or schedule a consultation with Austin Benefits today!