Last week for Life Insurance Awareness month, we brought you an overview of Life Insurance. Now let’s talk about facts and fiction when it comes to who really needs life insurance and when to consider purchasing coverage. Don’t forget to reach out to your dedicated Austin team or contact us if you have additional questions about Life Insurance or other employee benefits.

FACT – Who needs Life Insurance

When you’re young & healthy

Hey, that’s great! Buying life insurance is easier and much less expensive when you are young and healthy. But none of us is invincible, so there’s no better time to buy a policy to protect your loved ones. Don’t wait until you have an accident or fall ill to buy a life insurance policy, it will become much tougher to get affordable coverage.

You plan on having kids

With kids come growing expenses. It costs nearly $250,000 to raise a child to eighteen years old according to the USDA. Not only do you protect your insurability in the future by buying a policy now, you’re protecting your future family.

You live with a significant other

Even if you don’t have children, your significant other probably depends on you for some and maybe the majority of their financial security. Your funeral expenses may also fall on them directly. Having a life insurance policy in place can help relieve some if not all of the financial burden, and make sure they are able to live securely without your income if you pass away.

If you have student loans

You may assume that all your debts die with you, but that may not be the case. If you have personal student loans or other debts that required a cosigner, that person could still be responsible for the debt even after you die. There are even instances when a bank called for loans to be paid in full immediately following a death.

FICTION – Who needs Life Insurance

It’s too expensive

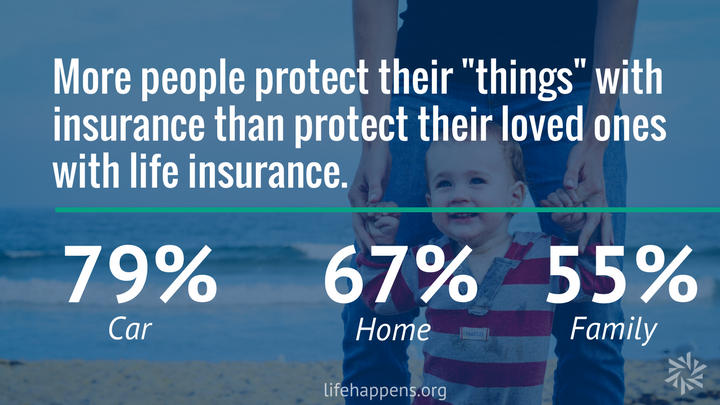

There may be many other regular payments such as home insurance, car payment & insurance, student loans, utilities, and more cutting down your budget, but don’t think that life insurance isn’t as important as any of those bills. Most people overestimate the cost of life insurance by 2 times, and in many cases you can get a great policy for less than your daily coffee order. Just think if money’s tight now, what will your loved ones do if something happens to you?

It’s only for babies and older people

You may be used to seeing or hearing ads like “Get Life Insurance At Any Age!” or “Protect Your New Baby with Life Insurance,” but these are only very specific products. There are just as many insurance products out there for young singles, working parents, just about anybody! This is where it can be helpful to work with an advisor to find the best provider and policy for your needs. You can contact the experts at Austin Benefits Group, we help both employers and individuals.

I already have life insurance through work

Fortunately, many people are provided with some life insurance as part of their employer-provided benefit package. With new generations entering the job market, this may be your first time seeing life insurance. A $50,000 policy or a small multiple of your salary may not be enough coverage. Also, if you ever leave your job you may lose this coverage and not be able to take it with you (called portability) or it may be very costly to port the coverage.

The good news is that if your employer offers a basic life plan, they may also pair it with voluntary (optional) life insurance so you can purchase more coverage for yourself and/or coverage for your spouse and dependents. This can sometimes offer savings in the rates you pay since it is group insurance versus buying individually. Still, look at the plan options including portability since voluntary plans can also be dependent on your continued employment with the company offering you the coverage.

I can buy life insurance anytime

This is somewhat true, you may be able to buy life insurance at over a period of time. It’s important to remember that the cost of your life insurance is based on your age, gender and sometimes on your health status at the time you purchase. It may be more difficult and more expensive to buy a policy if you wait.

Note: It’s often much more expensive for smokers to purchase life insurance, so make sure you consider quitting – you can find more help and guidance here. Your medical carrier and/or your employer may also have free programs and discounts to help you quit.

Ready to find out more about purchasing Life Insurance? Austin Benefits Group can help you find a plan that meets your needs, contact us today. Austin Benefits Group offers more than services for groups, the best team in benefits can help your employees or any individual looking for life insurance coverage.

Sources: