How to Boost Your Employee Benefits to Retain Top Talent

Unemployment rates continue to fall, and employers are competing for top talent highlighting the importance of a well-rounded employee benefits package.

Boosting your employee benefits can give your company the balance it needs between controlling the bottom line and retaining your top employees on board. Benefits are the second most important part of an employee’s compensation package, with salary holding the number one spot. A robust benefits package could easily make or break their decision to stay with your organization.

According to a recent SHRM study, 34% of organizations increased their benefits offerings in the last 12 months. Companies will need to look to their industry competitors, best-in-class examples, and experienced brokers to find out how they can boost their own benefits.

Check out these top tips to boost your own employee benefits package:

Health Care Benefits

Of your total benefits package, health care will likely be one of the most important for your employees. Making your healthcare offerings more competitive and attractive should be high on your list.

98% of the organizations in the SHRM study offered at least one health plan, and 69% offered multiple health plans. Offering more than one health care plan is easier than you think and can help you provide health care offerings that fit for more types of employees and their personal situations.

Read More: Why You Should Offer Multiple Health Plans

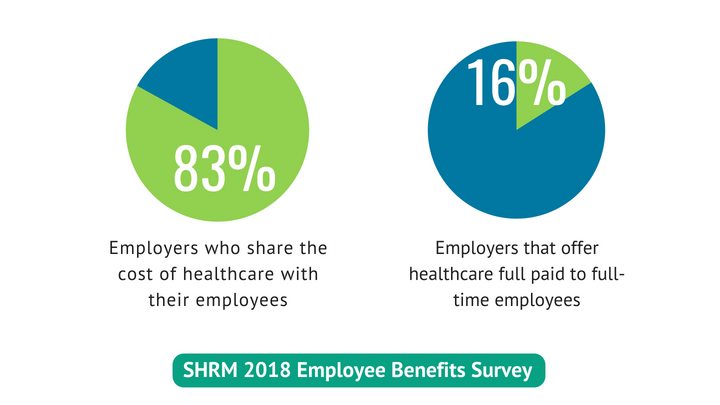

In addition to multiple health plans, consider sharing the burden of health care premium cost with your employees. Businesses can help mitigate the cost of sharing premiums by covering less for smokers, offering less cost share on dependents, requiring health screenings for cost-share eligibility, implementing a health-conscious wellness program, etc.

Take your health care benefits to the next level by offering a Flexible Spending Account, allowing your employees to save pre-tax money and use it towards medical expenses. Make sure to communicate with employees regularly to help remind them to make use of their funds on the wide range of expenses available.

Retirement Savings & Advice

Outside of your health care offerings, look to retirement benefits to meet employees expectations. Just remember that offering a plan may not be enough to be competitive.

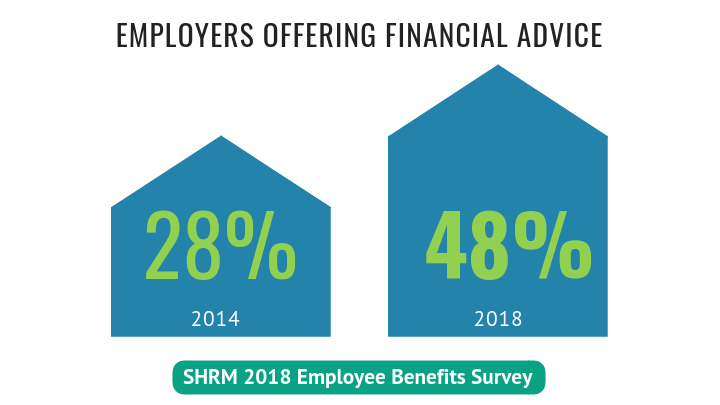

As millennials and even Gen Z take over the workplace, look for ways you can help them with financial education. Millennials, especially, are looking to save money and plan for retirement but may feel unsure where to turn for professional advice.

Ask your 401(k) provider to host regular meetings to educate your employees on plan offerings, but also on overall strategic tips for successful saving and retirement. When employees feel their employer cares about their success outside the workplace, they are more engaged and likely to stay with your organization.

Read More: The Connection Between Financial & Physical Wellness

Continuing Education & Loan Repayment

Another popular benefit, especially with your younger employees, is assistance with loan repayment. Although this can seem like a costly benefit, you can help mitigate costs by implementing certain rules. For this type of benefit, it is common for employers to limit eligibility for those who have been with the company for at least one year.

If loan repayment is not an option for your business, you can still show the value of education. Support your employees by assisting them in expanding their knowledge in your industry by offering continuing education support, specific time off for development opportunities, etc.

Only about 4% of groups in the SHRM study are providing student loan repayment. Companies looking to lead the way or really outshine their competitors should consider this widely desired but seldom offered benefit.

Read More: 101 Creative Employee Benefits Ideas for All Budgets

Communication & Experience

Make a plan to boost your employee benefits by consistently educating employees on your existing and new offerings. Year-round communication and education is one more way for companies to show their commitment to employees.

The experience employees have with enrolling in benefits can be overlooked but is extremely valuable for both your employees and HR team. When it’s easy to enroll, there’s less stress for everyone. Look to online enrollment platforms to make open enrollment and HR reporting easy.

In addition to the enrollment experience, consider employees’ year-round experience with their benefits. Are the carriers easy for them to work with? Do they have mobile applications, virtual visits options, etc. to help their benefits fit their lifestyle? Do you have someone who can help you field employee questions and claims issues? Does HR spend more time dealing with plan administration and paperwork than showcasing your benefits options or interacting with your employees? It might be time for you to consider an experienced broker partner who can help both your executive and HR team, but also your individual employees improve their benefits experience. If your broker isn’t helping with these issues, it’s time to start asking why not!

Not sure where to start in boosting your benefits to retain your top talent? Contact the Austin team for a no-hassle consultation and to hear about our custom communication options for your employees.

Source: SHRM

Like these ideas? Share this with your internet friends and follow us using the links below! We appreciate you spreading the benefits love.