The Beginner’s Guide to Dental Insurance & Savings

Aside from protecting your smile, dental care ensures good oral and overall health. Studies suggest that oral diseases, such as periodontitis (gum disease), can affect other areas of your body—including your heart. Understanding and choosing dental coverage will help protect you and your family from the cost of dental disease and other services.

What Is Dental Insurance?

Dental insurance is like medical insurance and is a common voluntary benefit option offered by employers. When you have dental insurance, you pay a premium and then your insurance will cover part or all the cost of many dental services.

Like medical insurance, dental coverage is offered in several types of plans:

Dental health maintenance organization (DHMO) – Coverage is only provided when you visit dentists who are in-network with the insurance plan.

Dental preferred provider organization (DPPO) – Coverage is provided with in- or out-of-network dental care providers, but you will typically pay less with an in-network dentist.

Dental indemnity plan – Coverage is provided for any dentist you choose, with no difference in cost.

Why Should I Have Dental Insurance?

Professional dental care can diagnose or help prevent common dental problems including toothaches, inflamed gums, tooth decay, bad breath and dry mouth. If conditions like these remain untreated, they can worsen into painful and expensive problems such as gum disease or even tooth loss. According to the American Dental Association, more than 16 million children in the United States suffer from untreated tooth decay, which is the most common chronic childhood disease. Regular dental exams can treat dental problems and identify other serious health concerns, including some types of cancer. Dental coverage will allow you to inexpensively receive preventive and diagnostic care.

What Dental Services Are Typically Covered?

Dental coverage focuses on preventive and diagnostic to avoid more expensive services associated with dental disease and surgery. The type of service or procedure received determines the amount of coverage for each visit. Each type of service fits into a class of services according to complexity and cost. Services are generally broken up into the following classes:

Class I – diagnostic and preventive care (cleanings, exams, X-rays)

Class II – basic care and procedures (fillings, root canals)

Class III – major care and procedures (crowns, bridges, dentures)

Class IV – orthodontia (braces)

Dental insurance generally focuses on preventive care, so Class I services are covered at the highest percentage. Class II services are then covered at a slightly lower percentage, followed by Class III services, which are covered at the lowest level. For example, if a plan follows an “100-80-50” structure, Class I services are covered at 100 percent, Class II at 80 percent and Class III at 50 percent.

Class IV services are frequently covered under a separate lifetime maximum (instead of the annual maximum) and often limit coverage to children under the age of 19.

In addition to the class of dental service, coverage also depends on other factors. Several common services are limited by frequency. For example, most plans will only cover two cleanings and exams per year. For more complicated procedures or surgeries, coverage is often limited to a maximum dollar amount, such as $1,500 per year. Age is yet another factor that determines coverage. For example, fluoride treatments are typically covered for children, but not adults. Cosmetic procedures, such as teeth-whitening, are rarely covered.

How Does Dental Insurance Work?

Dental insurance works similarly to a medical insurance plan. You pay premiums, and then the insurance will cover dental costs at a percentage (up to a maximum) according to the benefits listed in the plan. Other than some preventive care, most dental services are subject to a deductible and copay. Every plan is different, so read your benefit information carefully to understand your dental plan.

Real-Life Example

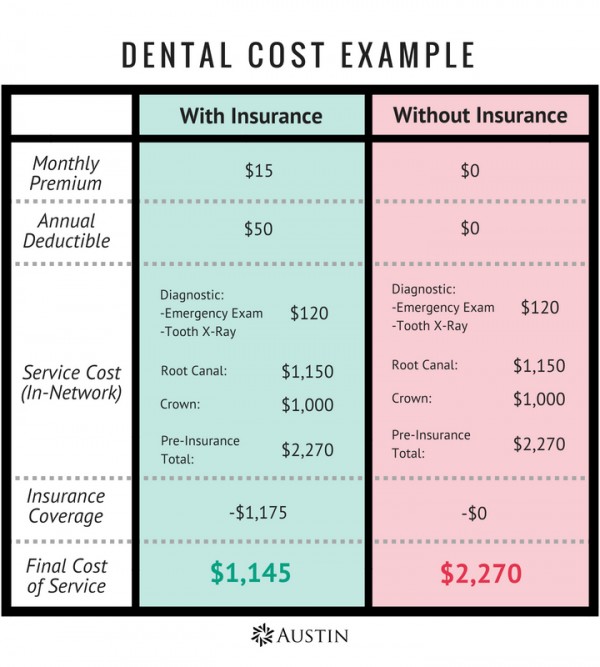

Maria is a young, healthy 24-year-old. One day, she cracks her tooth and is in serious pain. She goes to the dentist and finds out she needs to have a root canal and will need a crown. Fortunately, Maria has dental insurance, which will help offset the cost of this emergency dental procedure.

By paying less than $200 a year in premium to have dental coverage, Maria is able to save $1,125 on fixing her tooth. This is because her insurance covered the diagnostic cost 100 percent up to a certain amount, and the root canal and crown up to 50 percent each. Paying a modest monthly premium can help protect you in the event you or a family member experience a dental emergency like Maria.

What About Dental Insurance for Seniors?

Dental coverage is not included in Medicare Part A or B. If you’re a senior, using Medicare for your medical coverage, you can purchase employer-sponsored or individual dental plans as described earlier or these special plan options for Medicare users:

Medicare Advantage plan (Part C): Part C plans include routine coverage like dental, vision, and prescription drug coverage.

Medicare Supplement Plans (Medigap): “Medigap” plans are insurance to specifically help cover costs like deductibles and coinsurance. You pay a monthly premium, and after Medicare pays, this supplemental plan kicks in. Keep in mind you already need to have Part A and B to purchase a Medigap plan.

Contact the Austin Benefits Group to speak with our Individual Insurance & Medicare experts for help with Medicare Part C or Medigap plan comparison.

Request an Individual Insurance or Medicare Consultation

What Other Ways Can I Save Money on Dental Care?

Besides enrolling in a dental insurance plan, there are several other ways to make sure you get the best bang for your buck.

Flexible Spending Account: Did you know that Healthcare FSAs and Limited-Purpose FSAs cover many dental and vision services? Make sure you elect enough FSA funds to help cover your out-of-pocket dental expenses such as your deductible and co-insurance.

Stay In-Network: Even when you have a PPO style dental plan, staying in-network for dental services will save you money by ensuring you get the most coverage from your plan. Check out our Provider Directory for help finding a dentist.

Regular Preventive Care: Always use your preventive dental care that is covered 100%. Even though most of us don’t like the dentist, going regularly means you can catch serious issues sooner and even protect your overall health.

Looking for Employer Resources for Dental Insurance? Check out our Dental @ Work infographic and Voluntary Benefits Guide.