Austin Benefits Group CEO, Dean Austin, led the second half of our seminar with the 2017 Healthcare Pulse. He reviewed the history of the Affordable Healthcare Act (ACA), discussed the rising cost of healthcare and explained current and future drug trends. He concluded the seminar with his thoughts on the future of the health insurance industry in 2017 and beyond.

Dean’s review of the highlights of the ACA are featured in our downloadable infographic, simply fill out the form at the bottom of this post. Highlights for 2017 include the increase of the Out-of-Pocket maximum ($7,150 for self-only and $14,300 for family), the new SBC template for health plans beginning in April 2017, and the end of the reinsurance fees*.

He discussed some of the major changes within the public exchanges, most notably the large exodus of major insurance carriers throughout the country. The largest insurance carrier in the country, United Healthcare has exited all public exchanges except for three states, Virginia, New York, and Nevada¹. Aetna is also making a similar exit, remaining in the public exchanges in a few states¹.

The withdrawal from the public exchange is due to the extreme losses many carriers have felt due to higher-than-expected claims during the first few years the exchanges were open. Another hit for the carriers is the loss of their reinsurance in 2017 and beyond, which was provided by the federal government to offset their initial costs and encourage them to enter the public exchanges.

This will severely limit the number of choices people have on the public exchanges, result in higher premiums, and may have Americans looking for other health insurance solutions. The average premium increase across the U.S. public exchanges is 25%², and 1 in 5 Americans on the Public Exchange will only have one carrier to choose from².

In Michigan, Blue Cross Blue Shield is the only carrier that will be offering a PPO on the public exchange. Many of the large carriers in this area are requesting double-digit increases on their public exchange premiums.

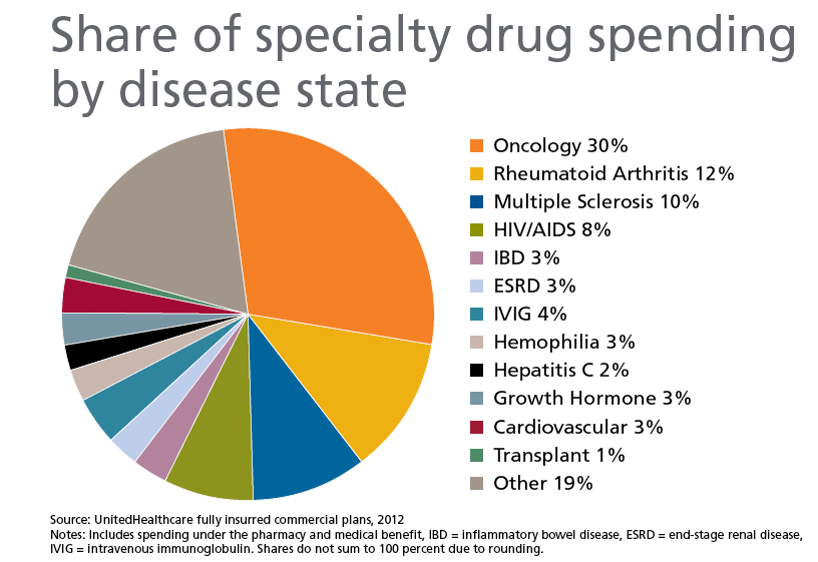

Another great concern for U.S. healthcare is the skyrocketing price of prescription drugs. Pharmacy spend has now surpassed inpatient, outpatient, and professional spend as the largest driver of healthcare costs³. Of prescription drugs, specialty drugs are the largest cost. They account for about 1% of prescription drugs being used, but account for nearly 37% of overall drug costs³. It is estimated that specialty drugs could account for up to 50% of the overall drug spend by 20184.

There has also been an increase in generic drug prices. This is due to several factors including mergers & buyouts at pharmaceutical companies, older drugs lacking competition in the market, and shortage of raw materials.

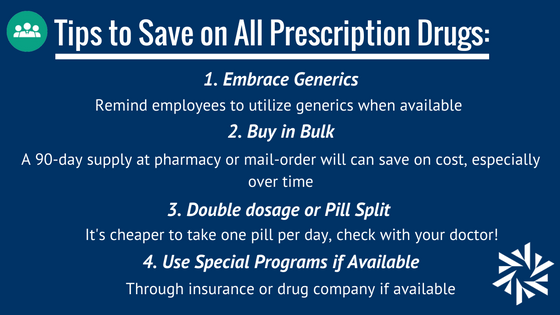

What steps can carriers and employers implement in their plan designs to control specialty drug costs and its impact on overall healthcare cost? There are four major provisions, many of which are becoming regular features of pharmacy plans:

1. Prior authorization: Patients must meet certain requirements for the medication to be covered

2. Step Therapy: requires patients first try a proven, but more affordable, drug before a more expensive alternative is covered.

3. Specialty pharmacies: Some carriers have specialty pharmacy option(s) to reduce costs. For example, BCBSM uses Walgreens Specialty Pharmacy.

4. Limit Supplies: limit supplies to 30 days to help avoid unnecessary expenses when a patient experiences intolerable side effects and discontinues usage or if the medication becomes no longer necessary.

Dean briefly covered the change in the BCBSM and BCN rating system, which will affect a great deal of group healthcare insurance plans in our state. The new rating system comes from a sister BCBS company called Highmark, which is the fourth-largest BCBS affiliated company and is among the 10 largest health insurers in the U.S. This new rating system will be reviewed in detail during renewal for each of our Austin clients that may be affected.

Also addressed was the rising popularity of self-funding among employers offering health insurance. Austin has experience handling both fully insured and self-funded group insurance and can help you business evaluate which option may be best for your business. Self-funded plans are when the employer pays for claims and administrative costs to the insurer as they go (usually weekly or monthly) instead of a flat monthly premium. Some of the larger carriers in Michigan including BCBSM, HAP, and United Healthcare are expanding the self-funded plan options.

Careful strategic planning can result in savings depending on a groups’ claims experience. Self-funding has the potential for a large savings in the right scenario, but also carries a certain amount of risk, so it is important to have a knowledgeable insurance expert on your side.

Dean closed the seminar with his thoughts on benefits in 2017 and 2018. With the changing public healthcare landscape, benefits will be more important than ever to employers and employees. Benefits will become crucial to attracting and maintaining quality talent and coordinating programs will enhance corporate culture.

It is also important to remember the giving employee choices in their benefits is of tremendous value. The Austin team can help you create a suite of benefits to offer your employees (and future employees) diverse and affordable choices.

If you missed out on our latest seminar, stay tuned on Facebook, LinkedIn, and Twitter for announcements of future seminars as wells as other benefits news. Thank you to all who attended, we are looking forward to the next Austin Seminar in 2017!

*2016’s reinsurance fees will be paid in 2017, but no future fees will be applied assuming no changes to this provision.

Sources:

1. healthinsurance.org

2. Fox Business Network

3. 2016 BCBSM Pharmacy Trends

4. National Health Expenditures, Artemetrx, CVS Caremark, 2013